It seems we don’t have any coupons for this category. Try searching for something else.

EARN FLAT ₹70 DIIO REWARDS CASHBACK WITH BAJAJ MUTUAL FUND KYC

Get ₹70 Diio Rewards Cashback

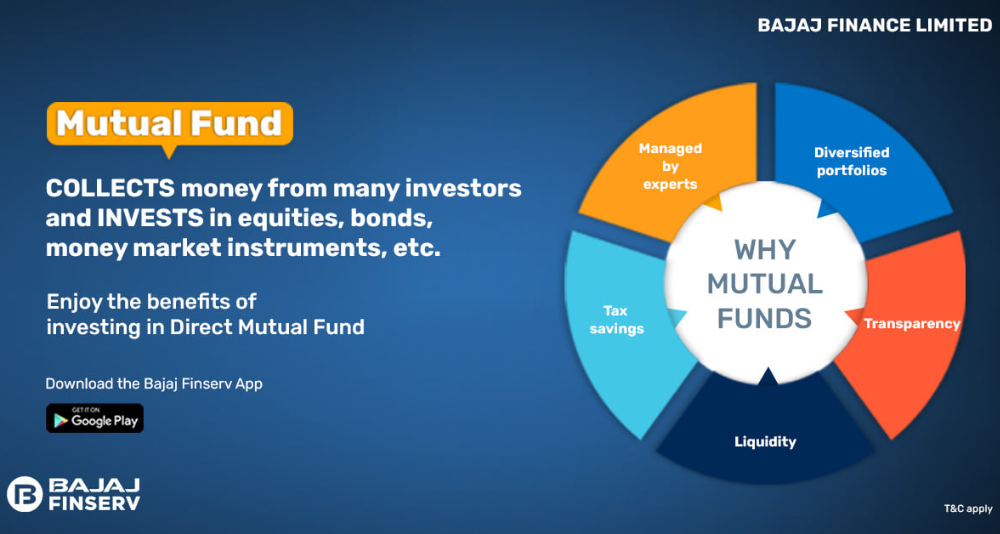

Bajaj Finserv Asset Management Limited is a wholly-owned subsidiary of Bajaj Finserv Limited. The AMC offers a plethora of innovative products and investment schemes across fixed income, equity and hybrid categories, offering investors to diversify their portfolio.

Bajaj Finserv Asset Management Limited has filed multiple schemes with the Securities and Exchange Board of India (SEBI) that includes the liquid fund, overnight fund, money market fund, flexi cap, arbitrage fund, balanced advantage fund, large and mid-cap fund, etc.

List of Bajaj Finserv Mutual Funds in India

| Fund Name | Category | Risk | 1Y Returns | Rating | Fund Size(in Cr) |

|---|---|---|---|---|---|

| Bajaj Finserv Flexi Cap Fund | Equity | Very High | NA | — | ₹2,238 |

| Bajaj Finserv Banking and PSU Fund | Debt | Moderate | NA | — | ₹99 |

| Bajaj Finserv Liquid Fund | Debt | Low to Moderate | NA | — | ₹2,140 |

| Bajaj Finserv Balanced Advantage Fund | Hybrid | Very High | NA | — | ₹926 |

| Bajaj Finserv Overnight Fund | Debt | Low | NA | — | ₹417 |

| Bajaj Finserv Money Market Fund | Debt | Low to Moderate | NA | — | ₹1,599 |

| Bajaj Finserv Arbitrage Fund | Hybrid | Low | NA | — | ₹377 |

How to Invest in Bajaj Finserv Mutual Funds

Refer to the following steps to invest in Bajaj Finserv Mutual Funds easily. It ensures transparency, ease of access and an overall superior experience while investing.

To invest in Bajaj Finserv Mutual Fund online, you can:

Step 1: Log in to your Bajaj Finserv MF account. New users must register first. It’s an easy procedure and requires no more than a few minutes.

Step 2: Submit your proof of identity (Voter ID card, Aadhaar, Passport, Driving license, etc.).

Step 3: Submit your proof of address (Ration cards or utility bills apart from the documents mentioned in the previous step).

Step 4: Choose a suitable Bajaj Finserv Mutual Fund Online investment period. The available options are short term, mid-term and long term investments.

Step 5: Choose the level of risk associated with the investment. Possible choices include low, mid and high-risk investments.

Step 6: Choose a Bajaj Finserv Mutual Fund online from the list of possible investment according to your preferences.

Step 7: Click on ‘Invest One Time’ or ‘Start SIP’ according to your requirements.

Your investment is now complete and should be processed in the next few hours.

Diio Rewards Profit Related –

- Tracking Time: Within 48 Hours

- Missing Profit Tickets: Accepted

- Confirmation Time: 30 days

- Profit on App orders: Not Applicable

- Profit on Referral Earnings: Not Applicable